Key Insights

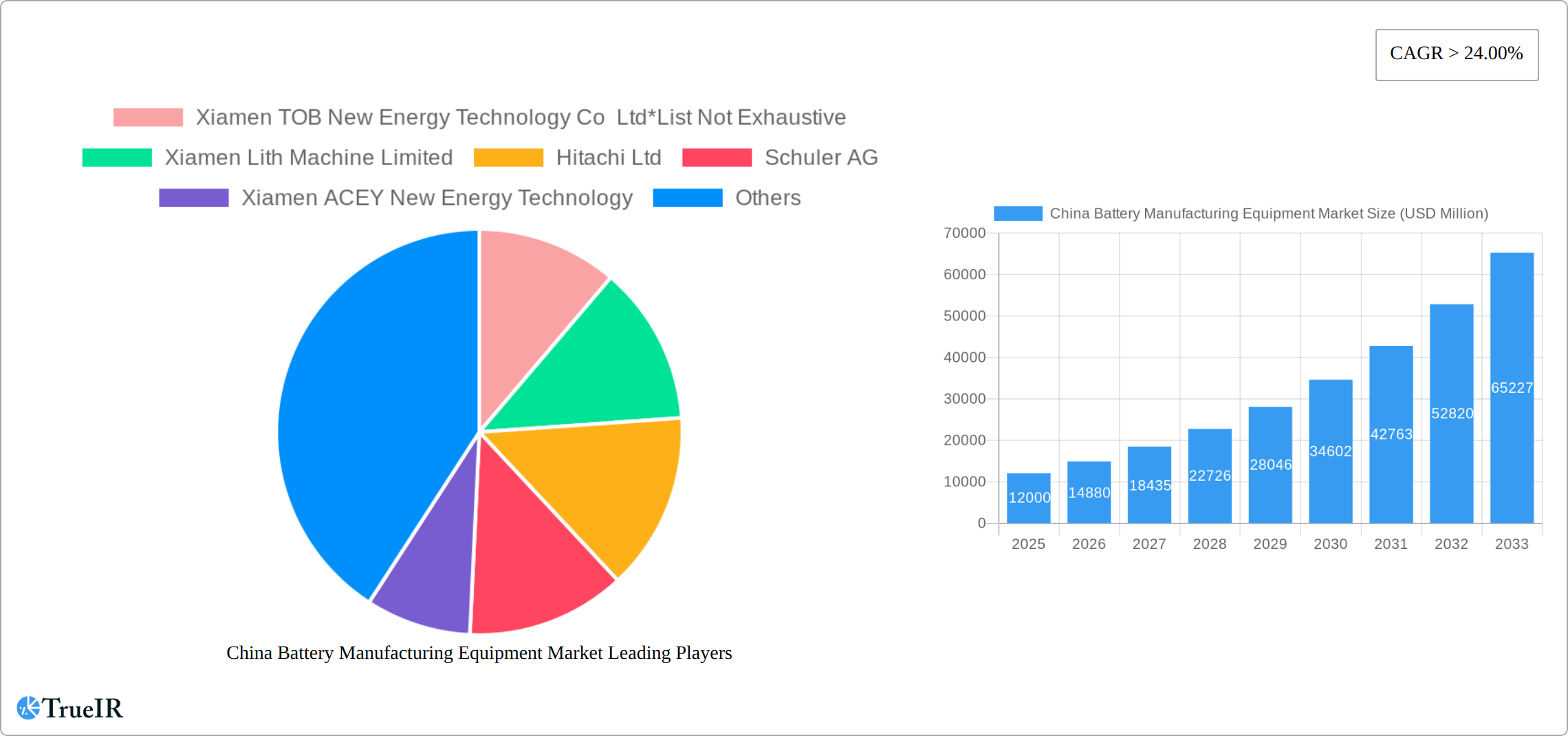

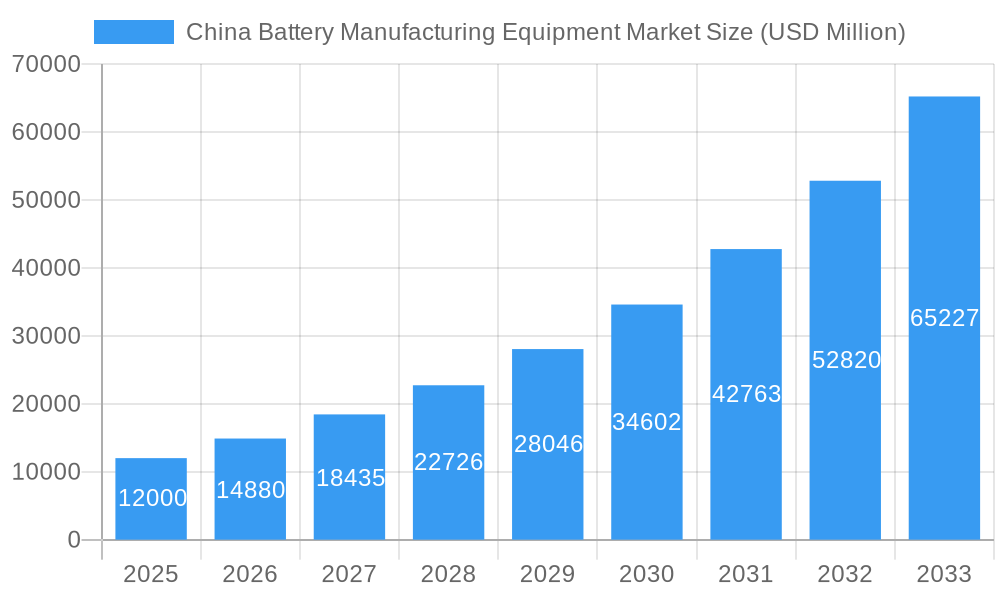

The China battery manufacturing equipment market is experiencing robust growth, projected to reach USD 12,000 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 24% from 2025 to 2033. This surge is driven primarily by the booming electric vehicle (EV) sector and the increasing demand for energy storage solutions within China. Key drivers include government incentives promoting EV adoption and renewable energy integration, substantial investments in battery production facilities, and advancements in battery technology necessitating sophisticated manufacturing equipment. The market is segmented by machine type, encompassing coating & drying, calendaring, slitting, mixing, electrode stacking, assembly & handling, and formation & testing machines. End-user segments include automotive, industrial applications, and other emerging sectors. Leading players like Xiamen TOB, Xiamen Lith Machine, Hitachi, Schuler AG, and Durr AG are capitalizing on this expansion, investing in research and development to offer advanced, high-efficiency equipment. The competitive landscape is dynamic, characterized by both domestic and international players vying for market share. While the market faces challenges such as supply chain disruptions and potential technological obsolescence, the overall outlook remains exceptionally positive, fueled by sustained growth in the battery industry and continuous technological innovation.

China Battery Manufacturing Equipment Market Market Size (In Billion)

The sustained high CAGR reflects several factors beyond EV adoption. The increasing focus on grid-scale energy storage solutions, portable electronics, and other applications requiring advanced batteries contributes significantly to the market's expansion. Furthermore, ongoing improvements in battery manufacturing processes, including automation and digitalization, are enhancing efficiency and yield, boosting demand for specialized equipment. The concentration of major battery manufacturers and related supply chains within China further solidifies its dominant position in the global battery manufacturing equipment market. While challenges exist regarding raw material sourcing and potential geopolitical influences, the long-term growth trajectory remains strongly upward, presenting significant opportunities for both established and emerging players in the industry.

China Battery Manufacturing Equipment Market Company Market Share

China Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the dynamic China Battery Manufacturing Equipment Market, providing invaluable insights for stakeholders across the entire value chain. From market sizing and segmentation to competitive landscape analysis and future outlook, this report equips you with the knowledge needed to navigate this rapidly evolving sector. The study period covers 2019-2033, with 2025 as the base year and forecast period spanning 2025-2033.

China Battery Manufacturing Equipment Market Structure & Competitive Landscape

The China Battery Manufacturing Equipment market is characterized by a moderately concentrated landscape, with both domestic and international players vying for market share. While precise concentration ratios are unavailable publicly (xx), the market exhibits a blend of established global giants like Hitachi Ltd and Schuler AG, alongside rapidly growing Chinese companies such as Xiamen TOB New Energy Technology Co Ltd and Xiamen Lith Machine Limited. Innovation plays a crucial role, driven by the relentless demand for higher energy density, faster production speeds, and improved cost-efficiency in battery manufacturing. Stringent environmental regulations in China further influence technological advancements, pushing manufacturers towards more sustainable and less polluting processes. The market sees substantial substitution potential, with ongoing R&D exploring new materials and manufacturing techniques. End-user segmentation is heavily skewed towards the burgeoning automotive sector, though industrial and other end-user segments are also experiencing significant growth. M&A activity in the sector, while not explicitly quantified (xx), is expected to be driven by the need for scale, technology acquisition, and expansion into new market segments, leading to ongoing consolidation within the industry. The competitive landscape is further shaped by factors like pricing pressures, supply chain complexities, and the overall pace of technological change.

China Battery Manufacturing Equipment Market Trends & Opportunities

The China Battery Manufacturing Equipment market is experiencing explosive growth, driven primarily by the country's aggressive push towards electric vehicle (EV) adoption and the broader expansion of energy storage solutions. The market size, currently estimated at USD xx million in 2025, is projected to reach USD xx million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by technological advancements leading to enhanced battery performance, increased production efficiency, and reduced manufacturing costs. Consumer preferences are shifting towards longer-lasting, higher-performing batteries, creating a demand for more sophisticated manufacturing equipment. The intense competitive dynamics contribute to continuous innovation and price optimization, making the market highly attractive for both established players and new entrants. Market penetration rates for advanced equipment technologies are increasing significantly, especially within the automotive segment, owing to the massive investment in electric vehicle manufacturing across China.

Dominant Markets & Segments in China Battery Manufacturing Equipment Market

The Chinese battery manufacturing equipment market is experiencing explosive growth, primarily fueled by the burgeoning electric vehicle (EV) industry. The automotive sector remains the dominant end-user, commanding over 70% of the market share in 2025, a projection driven by China's aggressive EV production expansion and ambitious decarbonization targets. Within the equipment segment, Assembly & Handling Machines and Formation & Testing Machines are demonstrating the highest growth trajectories. This is due to their indispensable roles in ensuring both the quality and the efficiency of battery production, with increased automation and precision being key drivers. Geographically, the most significant market concentration is observed in provinces with established EV manufacturing hubs, including Guangdong, Jiangsu, and Zhejiang, but expansion into other regions is rapidly occurring.

- Key Growth Drivers for Automotive Segment:

- Massive government support through subsidies and incentives promoting EV adoption.

- Rapid expansion of domestic EV manufacturers, consolidating their position in the global market.

- Strong growth in consumer demand for electric and hybrid vehicles, driven by environmental concerns and technological advancements.

- Stringent emission regulations pushing the transition to electric mobility.

- Key Growth Drivers for Assembly & Handling Machines Segment:

- The imperative for increased automation to improve production speed, precision, and overall efficiency.

- Rising demand for high-throughput production lines capable of meeting the escalating demand for EV batteries.

- Significant advancements in robotic technologies, including the utilization of sophisticated automated guided vehicles (AGVs) and collaborative robots (cobots).

- Key Growth Drivers for Formation & Testing Machines Segment:

- Implementation of increasingly stringent quality control standards for battery packs to ensure safety and performance.

- Growing emphasis on enhancing battery performance and extending lifespan, driving demand for advanced testing capabilities.

- Technological advancements resulting in faster, more precise, and cost-effective testing methods.

China Battery Manufacturing Equipment Market Product Analysis

The China Battery Manufacturing Equipment market showcases continuous innovation in areas like automation, precision, and efficiency. Advancements in robotics, AI-powered process optimization, and high-precision manufacturing techniques are transforming the industry. The focus is increasingly on developing equipment that can handle larger-format batteries, improve yield, and minimize waste. These innovations are designed to enhance the competitiveness of battery manufacturers in a global market.

Key Drivers, Barriers & Challenges in China Battery Manufacturing Equipment Market

Key Drivers:

- The booming EV market in China is the primary driver, fueled by government policies promoting electric mobility and substantial investments in battery manufacturing capacity.

- Technological advancements, such as improved automation and AI-powered process optimization, are improving efficiency and reducing costs.

Key Challenges:

- Intense competition from both domestic and international players leads to price pressures and limits profit margins.

- Supply chain disruptions, especially concerning critical raw materials, can impact production and profitability.

- Regulatory changes and evolving safety standards require continuous adaptation and investment.

Growth Drivers in the China Battery Manufacturing Equipment Market

The rapid expansion of the electric vehicle (EV) industry in China serves as the primary growth catalyst. Government policies incentivizing EV adoption and substantial investments in battery manufacturing facilities are directly fueling demand for advanced equipment. Moreover, advancements in battery technologies, such as higher energy density and faster charging capabilities, necessitate sophisticated manufacturing equipment, creating an ongoing need for upgrades and innovation within the market. Finally, increased automation and digitalization within manufacturing processes are significantly improving efficiency and reducing production costs.

Challenges Impacting China Battery Manufacturing Equipment Market Growth

Despite its significant potential, the Chinese battery manufacturing equipment market faces notable challenges. Supply chain vulnerabilities, particularly regarding access to critical raw materials like lithium, cobalt, and nickel, represent a significant risk, potentially disrupting production schedules and increasing costs. Furthermore, intense competition from both established international players and rapidly growing domestic companies creates a highly competitive landscape, pressuring profit margins. Navigating the constantly evolving regulatory environment and meeting stringent safety standards require continuous adaptation and investment from manufacturers, adding to operational complexity.

Key Players Shaping the China Battery Manufacturing Equipment Market

- Hitachi Ltd

- Schuler AG

- Durr AG

- Andritz AG

- Manz AG

- Xiamen TOB New Energy Technology Co Ltd

- Xiamen Lith Machine Limited

- Xiamen ACEY New Energy Technology

- Wuxi Lead Intelligent Equipment Co Ltd

- Xiamen Tmax Battery Equipments Limited

Significant China Battery Manufacturing Equipment Market Industry Milestones

- December 2022: GAC Group's USD 1.561 billion investment in a new 6 GWh electric vehicle battery production facility in Guangzhou, slated for operation in March 2024, underscores the substantial expansion in domestic battery production capacity and resulting demand for advanced manufacturing equipment.

- November 2022: BYD's announcement of a new 20 GWh battery production plant in Wenzhou, Zhejiang province, commencing production in 2024, signifies the ongoing growth and consolidation within the Chinese battery industry, further stimulating demand for sophisticated manufacturing equipment. This expansion highlights the strategic investments being made to secure market share and meet the growing demand for EVs.

- [Add another recent milestone here with date and brief description]

Future Outlook for China Battery Manufacturing Equipment Market

The outlook for the China Battery Manufacturing Equipment market remains exceptionally positive. The sustained growth of the EV sector, combined with the increasing adoption of energy storage solutions across diverse applications (e.g., stationary energy storage systems), will fuel persistent demand for sophisticated and efficient manufacturing equipment. Companies capable of providing innovative, efficient, and cost-competitive solutions will be well-positioned to capture significant market share. The market presents substantial opportunities for expansion, creating a lucrative environment for both established industry leaders and new entrants. The continued focus on technological advancement, sustainability, and enhanced battery performance will drive further innovation within this dynamic sector.

China Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

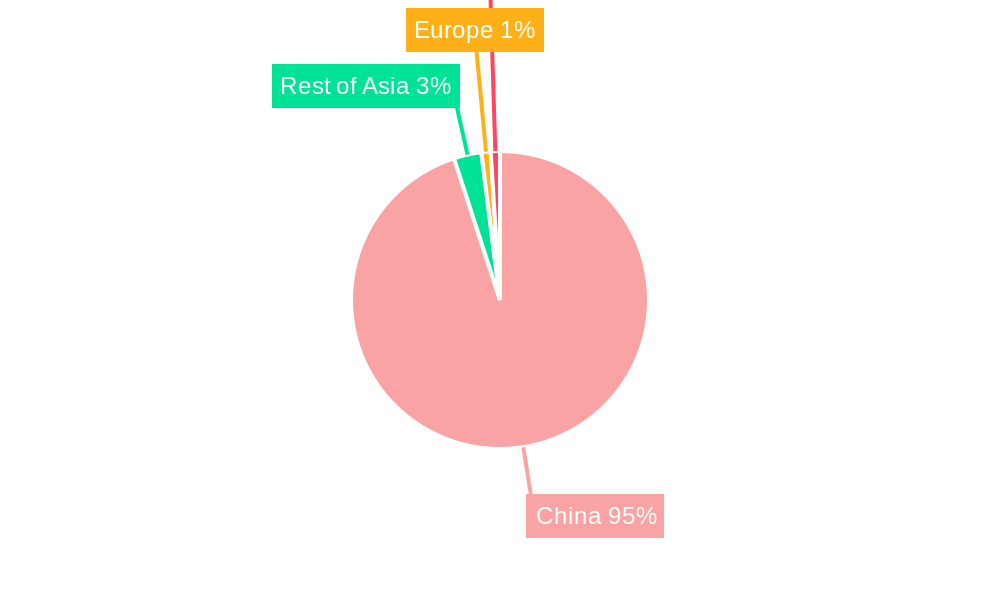

China Battery Manufacturing Equipment Market Segmentation By Geography

- 1. China

China Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of China Battery Manufacturing Equipment Market

China Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 24.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Lith Machine Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xiamen ACEY New Energy Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wuxi Lead Intelligent Equipment Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Andritz AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Xiamen Tmax Battery Equipments Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Manz AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: China Battery Manufacturing Equipment Market Revenue Breakdown (USD Million, %) by Product 2025 & 2033

- Figure 2: China Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Machine Type 2020 & 2033

- Table 2: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 3: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by End User 2020 & 2033

- Table 4: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 5: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Region 2020 & 2033

- Table 6: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Machine Type 2020 & 2033

- Table 8: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 9: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by End User 2020 & 2033

- Table 10: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 11: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Country 2020 & 2033

- Table 12: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Battery Manufacturing Equipment Market?

The projected CAGR is approximately > 24.00%.

2. Which companies are prominent players in the China Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive, Xiamen Lith Machine Limited, Hitachi Ltd, Schuler AG, Xiamen ACEY New Energy Technology, Durr AG, Wuxi Lead Intelligent Equipment Co Ltd, Andritz AG, Xiamen Tmax Battery Equipments Limited, Manz AG.

3. What are the main segments of the China Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12000 USD Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

In December 2022, the Chinese car company GAC announced that they had started building a production facility for electric car batteries in Guangzhou. With a total investment of USD 1.561 billion, the new factory is scheduled to operate in March 2024 with an annual production capacity of 6 GWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in USD Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the China Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence