Key Insights

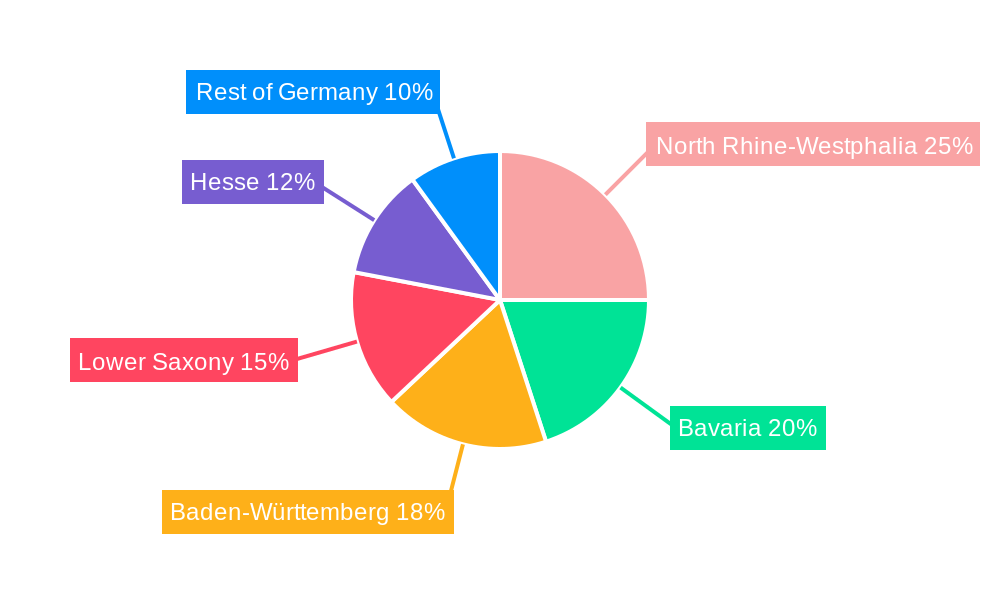

Germany's fuel cell industry is poised for significant expansion, propelled by substantial government backing for renewable energy and escalating demand for clean energy solutions across diverse sectors. The market, with a projected CAGR of 25.9% from 2025 to 2033, is forecast to reach $10.64 billion by 2025. Key growth drivers include the increasing integration of fuel cell technology in portable power applications, such as backup and specialized equipment, stationary power generation including combined heat and power (CHP) systems for buildings, and the rapidly advancing transportation sector, particularly for buses, trains, and emerging light-duty vehicles. Germany's firm commitment to decarbonization and strategic investments in R&D are accelerating market development. Technological innovations in Polymer Electrolyte Membrane Fuel Cells (PEMFCs) and Solid Oxide Fuel Cells (SOFCs) are enhancing efficiency and reducing costs, making fuel cell technology increasingly competitive. Leading companies such as SFC Energy AG, FuelCell Energy Inc., and Ballard Power Systems Inc. are spearheading market advancements through innovation and strategic alliances. The robust German industrial landscape, particularly in North Rhine-Westphalia, Bavaria, and Baden-Württemberg, significantly bolsters the industry's capabilities.

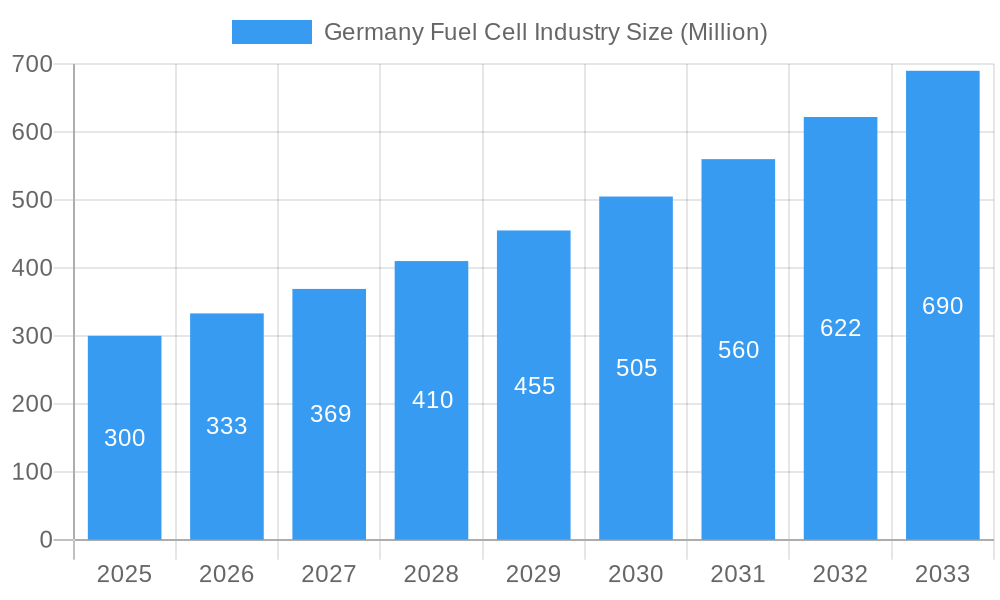

Germany Fuel Cell Industry Market Size (In Billion)

Despite the positive outlook, the German fuel cell market confronts challenges, primarily high initial investment costs for fuel cell systems and the ongoing development of hydrogen production and distribution infrastructure, which may impede the widespread adoption of fuel cell vehicles and stationary applications. Addressing these barriers necessitates sustained governmental support, technological innovation focused on cost optimization, and the establishment of a comprehensive hydrogen ecosystem. Nevertheless, the long-term prospects for the German fuel cell market remain exceptionally strong, driven by the critical need for climate change mitigation and continuous technological progress that enhances the viability of this clean energy alternative. Focused development within specific application segments and regional markets in Germany will further refine market dynamics and foster increased specialization.

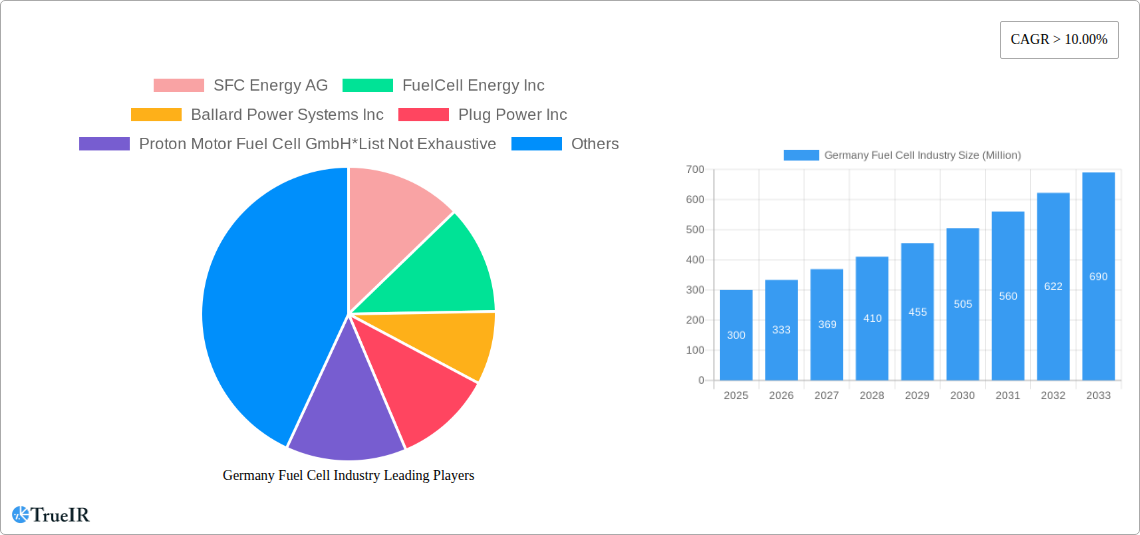

Germany Fuel Cell Industry Company Market Share

This in-depth report offers comprehensive analysis of the German fuel cell industry, providing critical insights for investors, industry stakeholders, and policymakers. Covering the period from 2019 to 2033, with a focus on the 2025 base year, it delves into market structure, trends, key players, and future projections. The report employs a rigorous methodology, integrating qualitative and quantitative data to deliver a clear and actionable understanding of this dynamic sector, including projected market size figures.

Germany Fuel Cell Industry Market Structure & Competitive Landscape

The German fuel cell market is characterized by a moderately concentrated landscape, with key players such as SFC Energy AG, FuelCell Energy Inc, Ballard Power Systems Inc, Plug Power Inc, Proton Motor Fuel Cell GmbH, and Hydrogenics Corporation vying for market share. However, the presence of numerous smaller companies and startups signifies a dynamic and competitive environment. The market concentration ratio (CR4) is estimated to be around xx% in 2025, indicating a moderate level of consolidation. Innovation is a key driver, with ongoing R&D efforts focused on improving fuel cell efficiency, durability, and cost-effectiveness. Stringent environmental regulations in Germany are creating a favorable regulatory environment, driving demand for cleaner energy solutions. The emergence of battery technology as a potential substitute poses a challenge, but the unique advantages of fuel cells in terms of energy density and refueling time are expected to maintain their relevance in specific applications. End-user segmentation is crucial, with significant demand from the transportation, stationary power, and portable power sectors. M&A activity has been moderate in recent years, with xx Million in total deal value recorded between 2019 and 2024, indicating potential for increased consolidation in the coming years.

- Market Concentration: CR4 estimated at xx% in 2025.

- Innovation Drivers: R&D focused on efficiency, durability, and cost reduction.

- Regulatory Impacts: Stringent environmental regulations promote fuel cell adoption.

- Product Substitutes: Battery technology presents a competitive challenge.

- End-User Segmentation: Transportation, stationary, and portable power sectors are key.

- M&A Trends: Moderate activity, with xx Million in deal value (2019-2024).

Germany Fuel Cell Industry Market Trends & Opportunities

The German fuel cell market is poised for significant growth over the forecast period (2025-2033). The market size is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from 2025. This growth is fueled by several factors, including increasing government support for renewable energy initiatives, rising awareness about environmental sustainability, and technological advancements leading to improved fuel cell performance and reduced costs. Consumer preference for environmentally friendly energy solutions is another key driver, particularly in the transportation sector. The competitive landscape is dynamic, with both established players and new entrants vying for market share through innovation and strategic partnerships. Market penetration rates are expected to increase significantly, particularly in the transportation segment, driven by the deployment of hydrogen fuel cell buses and trains. Further opportunities exist in stationary power generation, particularly for backup power and off-grid applications, and the portable power market, including applications in military and emergency services.

Dominant Markets & Segments in Germany Fuel Cell Industry

The transportation segment is expected to dominate the German fuel cell market throughout the forecast period, driven by strong government support and increasing demand for zero-emission vehicles. Within fuel cell technologies, Polymer Electrolyte Membrane Fuel Cells (PEMFCs) currently hold the largest market share, due to their suitability for various applications. However, Solid Oxide Fuel Cells (SOFCs) are expected to witness significant growth, driven by advancements in technology and increasing interest in high-efficiency stationary power generation. The stationary power segment is also experiencing strong growth, driven by the increasing need for reliable and clean backup power solutions. Other fuel cell technologies are also gaining traction in niche applications.

- Key Growth Drivers for Transportation:

- Government incentives and subsidies for hydrogen fuel cell vehicles.

- Increasing demand for zero-emission public transportation.

- Development of hydrogen refueling infrastructure.

- Key Growth Drivers for Stationary Power:

- Growing need for reliable and clean backup power solutions.

- Increasing demand for decentralized energy generation.

- Potential for integration with renewable energy sources.

Germany Fuel Cell Industry Product Analysis

Fuel cell technology is continuously evolving, with advancements focused on improving efficiency, durability, and reducing costs. PEMFCs remain the dominant technology, particularly in transportation applications, while SOFCs are gaining traction in stationary power. The focus is on developing cost-effective and high-performance fuel cells that are suitable for a wide range of applications. Competitive advantages are often based on factors such as efficiency, lifespan, and cost, with companies focusing on developing unique product features and capabilities to gain a competitive edge.

Key Drivers, Barriers & Challenges in Germany Fuel Cell Industry

Key Drivers:

Technological advancements, supportive government policies, and the growing demand for cleaner energy sources are key drivers of growth. The German government's commitment to reducing carbon emissions is creating a favorable environment for fuel cell adoption. Furthermore, continuous improvements in fuel cell efficiency and durability are lowering costs and enhancing the appeal of fuel cell technology.

Challenges:

High initial investment costs, limited hydrogen refueling infrastructure, and competition from other energy technologies such as batteries present significant challenges. Supply chain disruptions and potential regulatory hurdles could also affect market growth. The current infrastructure limitations pose a significant constraint, limiting widespread fuel cell adoption.

Growth Drivers in the Germany Fuel Cell Industry Market

Government support, technological innovation, and increasing environmental concerns are major growth drivers. Specific policies promoting renewable energy and hydrogen infrastructure play a significant role. Furthermore, continuous advancements in fuel cell technology are leading to improved efficiency, durability, and reduced costs, all making fuel cells more competitive.

Challenges Impacting Germany Fuel Cell Industry Growth

High capital expenditure, limited hydrogen infrastructure, and competition from alternative technologies are key challenges. Supply chain vulnerabilities and regulatory uncertainties create additional barriers. Addressing these challenges through strategic investments and policy interventions is essential for sustainable market growth. The estimated xx Million needed for infrastructure development until 2033 highlights the magnitude of this issue.

Key Players Shaping the Germany Fuel Cell Industry Market

- SFC Energy AG

- FuelCell Energy Inc

- Ballard Power Systems Inc

- Plug Power Inc

- Proton Motor Fuel Cell GmbH

- Hydrogenics Corporation

Significant Germany Fuel Cell Industry Industry Milestones

- May 2022: Wrightbus secured a contract to supply 60 hydrogen fuel cell buses to Cologne.

- August 2022: Successful trials led to the deployment of a 14-train fuel cell passenger fleet in Lower Saxony. This marked a significant step towards decarbonizing the German rail network.

Future Outlook for Germany Fuel Cell Industry Market

The German fuel cell market is expected to experience significant growth in the coming years, driven by supportive government policies, technological advancements, and increasing environmental awareness. Strategic opportunities exist in various segments, including transportation, stationary power, and portable power. The market's future potential is substantial, presenting attractive investment opportunities for both established players and new entrants. Continued investment in research and development, coupled with supportive government policies and infrastructure development, will be crucial in realizing the full potential of the German fuel cell industry.

Germany Fuel Cell Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

Germany Fuel Cell Industry Segmentation By Geography

- 1. Germany

Germany Fuel Cell Industry Regional Market Share

Geographic Coverage of Germany Fuel Cell Industry

Germany Fuel Cell Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Costs

- 3.4. Market Trends

- 3.4.1. Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Fuel Cell Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SFC Energy AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FuelCell Energy Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ballard Power Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plug Power Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Proton Motor Fuel Cell GmbH*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hydrogenics Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 SFC Energy AG

List of Figures

- Figure 1: Germany Fuel Cell Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Fuel Cell Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Fuel Cell Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Germany Fuel Cell Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 3: Germany Fuel Cell Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Fuel Cell Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Germany Fuel Cell Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 6: Germany Fuel Cell Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Fuel Cell Industry?

The projected CAGR is approximately 25.9%.

2. Which companies are prominent players in the Germany Fuel Cell Industry?

Key companies in the market include SFC Energy AG, FuelCell Energy Inc, Ballard Power Systems Inc, Plug Power Inc, Proton Motor Fuel Cell GmbH*List Not Exhaustive, Hydrogenics Corporation.

3. What are the main segments of the Germany Fuel Cell Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.64 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration.

6. What are the notable trends driving market growth?

Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Costs.

8. Can you provide examples of recent developments in the market?

August 2022: The successful trials of hydrogen-fuelled passenger trains in Germany led to the deployment of the first fuel cell train fleet (14 trains) in Lower Saxony.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Fuel Cell Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Fuel Cell Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Fuel Cell Industry?

To stay informed about further developments, trends, and reports in the Germany Fuel Cell Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence