Key Insights

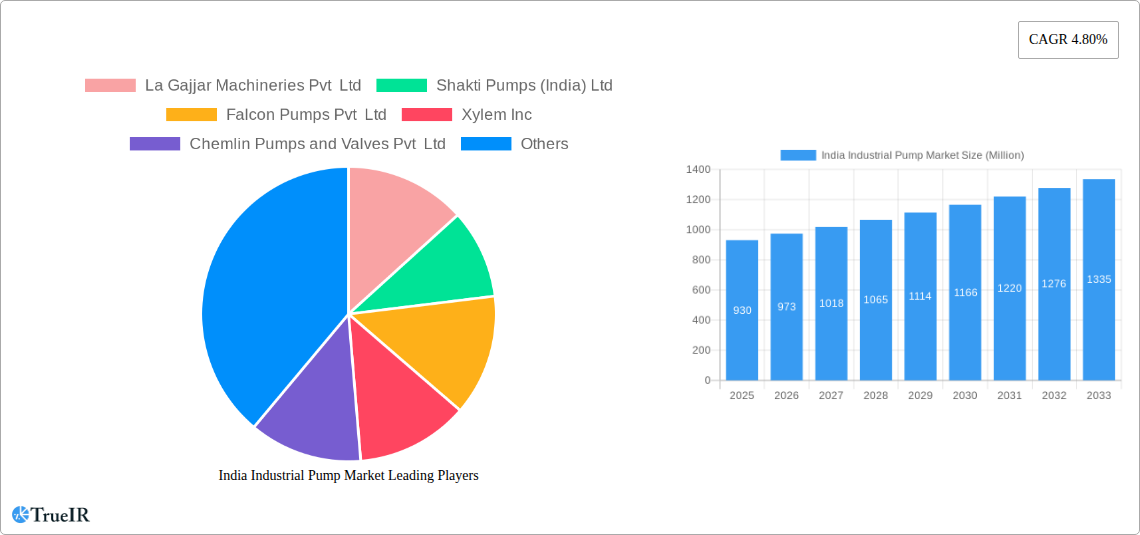

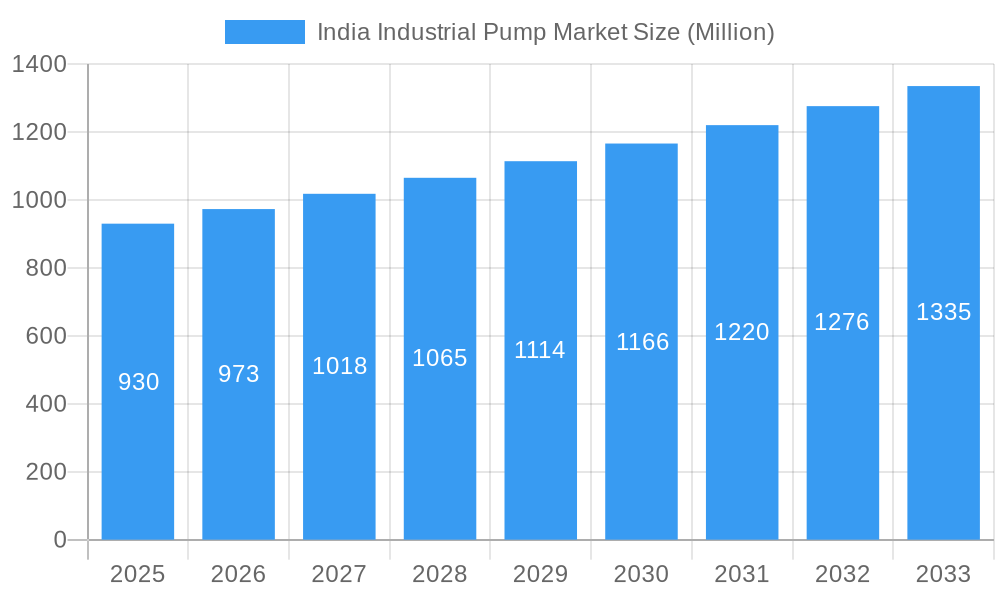

The India industrial pump market, valued at $0.93 billion in 2025, is projected to experience robust growth, driven by increasing industrialization, expanding infrastructure projects, and rising demand across diverse sectors. A compound annual growth rate (CAGR) of 4.80% from 2025 to 2033 indicates a significant market expansion. Key drivers include the burgeoning oil and gas, water and wastewater treatment, and chemical & petrochemical industries. Government initiatives promoting industrial development and infrastructure modernization further fuel this growth. The market is segmented by pump type (centrifugal and positive displacement) and end-user industry (oil and gas, water and wastewater, chemicals and petrochemicals, mining, power generation, and others). While the market faces challenges like fluctuating raw material prices and stringent environmental regulations, the overall outlook remains positive due to sustained investment in industrial capacity and technological advancements in pump efficiency and reliability. Competition is fierce, with both domestic players like Shakti Pumps, Kirloskar Brothers, and CRI Pumps, and international giants like Xylem and Grundfos vying for market share. Regional variations exist, with potentially higher growth in regions experiencing rapid industrialization. Future growth will likely depend on technological innovation, adoption of energy-efficient pumps, and sustained government support for infrastructure development.

India Industrial Pump Market Market Size (In Million)

The market's segmentation offers strategic opportunities for players to focus on specific niche areas. Centrifugal pumps, given their versatility and cost-effectiveness, are expected to maintain a dominant share. However, the growing need for precise fluid handling in specialized applications will likely boost demand for positive displacement pumps. The oil and gas sector, alongside water and wastewater management, will continue to be major contributors to market revenue. Expansion into renewable energy projects and sustainable industrial practices will also present significant growth avenues in the coming years. Companies are focusing on product innovation, strategic partnerships, and expansion into new geographic markets to capitalize on these opportunities and maintain a competitive edge in this dynamic landscape.

India Industrial Pump Market Company Market Share

India Industrial Pump Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the India Industrial Pump Market, offering invaluable insights for industry stakeholders. With a focus on key market segments, competitive dynamics, and future growth projections, this report is an essential resource for strategic decision-making. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The market is valued in Millions.

India Industrial Pump Market Structure & Competitive Landscape

The Indian industrial pump market exhibits a moderately concentrated structure, with a handful of large players and numerous smaller, regional competitors. Key factors shaping this landscape include:

Market Concentration: While precise concentration ratios are difficult to definitively quantify without access to specific internal company data, preliminary estimates suggest a Herfindahl-Hirschman Index (HHI) value in the range of xx, suggesting moderate market concentration. This is influenced by the presence of multinational corporations and established Indian manufacturers.

Innovation Drivers: The market is driven by ongoing technological advancements, including the development of energy-efficient pumps, smart pumps with integrated monitoring capabilities, and the increasing adoption of digital technologies for predictive maintenance. Further, the growing need for water conservation and efficient resource management spurs innovation in water pump technologies.

Regulatory Impacts: Government regulations concerning energy efficiency, environmental protection, and safety standards significantly influence the market. These regulations often drive the adoption of newer, more compliant pump technologies.

Product Substitutes: While pumps are essential, some applications might consider alternative fluid handling technologies based on specific needs and cost factors, although they remain niche substitutes.

End-User Segmentation: The market is segmented across diverse end-user industries, including Oil and Gas, Water and Wastewater, Chemicals and Petrochemicals, Mining, Power Generation, and Other End-user Industries. Each segment presents unique demands in terms of pump type, capacity, and performance.

M&A Trends: The Indian industrial pump market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, primarily focused on consolidating market share and expanding product portfolios. The number of transactions is estimated to be xx per year over the past five years. These activities further shape the competitive landscape.

The qualitative analysis indicates that strategic partnerships and technological collaborations are increasingly prevalent.

India Industrial Pump Market Market Trends & Opportunities

The India Industrial Pump Market is experiencing robust growth, driven by factors such as expanding industrialization, urbanization, and infrastructure development. The market size is projected to reach xx Million by 2025 and xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is fueled by various factors, including:

Increasing demand from various end-user industries: The expanding industrial sector, particularly in sectors such as water and wastewater treatment, oil & gas, and power generation, significantly contributes to market growth.

Government initiatives: Government policies and investment in infrastructure projects, such as the Smart Cities Mission and the Jal Jeevan Mission, are driving demand for efficient and reliable industrial pumps.

Technological advancements: The ongoing development and adoption of advanced pump technologies like centrifugal pumps, positive displacement pumps, and smart pumps are positively influencing market growth.

Rising focus on energy efficiency: Growing concerns about energy consumption and environmental sustainability are prompting the adoption of energy-efficient pump models, stimulating market expansion.

Changing consumer preferences: The trend towards automated and digitally enhanced industrial solutions is driving the adoption of smart pumps with features like remote monitoring and predictive maintenance.

The market penetration rate for advanced pump technologies is gradually increasing, and this trend is expected to continue through the forecast period. However, price competitiveness among manufacturers and evolving technological advancements are creating significant opportunities.

Dominant Markets & Segments in India Industrial Pump Market

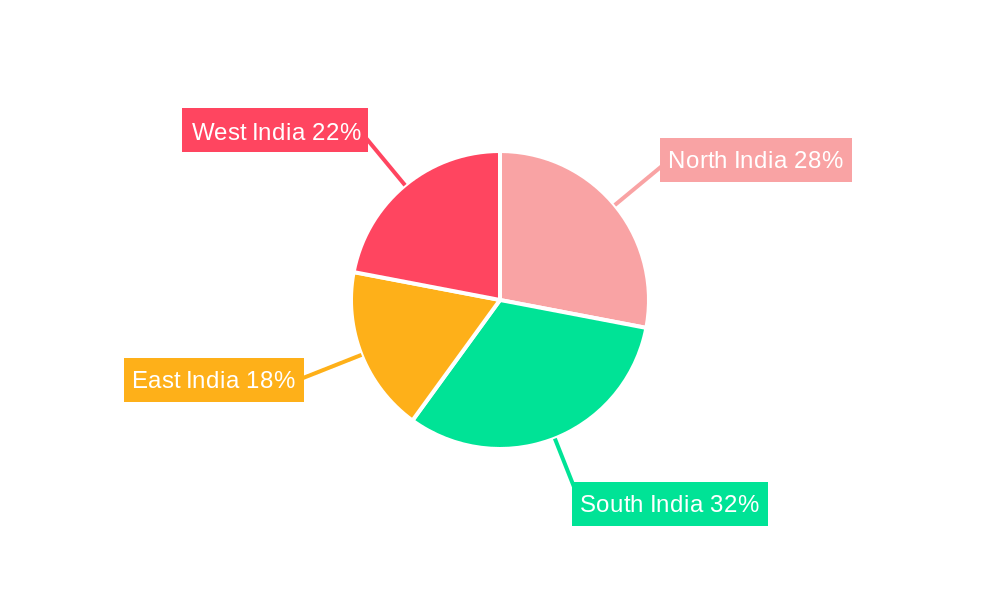

The Indian industrial pump market is geographically diverse, with significant growth observed across various regions. However, a detailed analysis requires specific regional data not currently available. Within the market segmentation, we can point to certain trends:

Type: Centrifugal pumps currently dominate the market due to their versatility and cost-effectiveness across diverse applications. Positive displacement pumps also hold a significant share, particularly in specialized applications requiring precise fluid delivery.

End-User Industry: The water and wastewater treatment sector stands as a significant driver of market demand due to rising urbanization and the need for improved sanitation infrastructure. The Oil and Gas sector's expansion also plays a major role.

Key Growth Drivers:

- Infrastructure Development: Massive investments in infrastructure projects across various sectors are fueling demand.

- Government Policies: Pro-industrialization policies and incentives for water management are creating favorable market conditions.

- Industrial Expansion: Rapid industrialization in diverse sectors such as manufacturing and chemicals significantly increases the demand for industrial pumps.

India Industrial Pump Market Product Analysis

The Indian industrial pump market is witnessing significant product innovation. Technological advancements are focusing on energy efficiency, improved reliability, and smart features. Centrifugal pumps are widely used due to their versatility and efficiency in diverse applications. Positive displacement pumps find applications where precise fluid control is crucial. Competition is driven by superior performance characteristics, enhanced energy efficiency, and advanced monitoring capabilities. Many pumps offer customizable features tailored to the unique needs of end-user industries.

Key Drivers, Barriers & Challenges in India Industrial Pump Market

Key Drivers:

The market's growth is primarily driven by burgeoning industrialization, infrastructure development projects (especially in water management), and rising adoption of energy-efficient pump technologies. Government initiatives supporting water conservation and industrial modernization are also crucial factors.

Challenges & Restraints:

The market faces challenges like fluctuating raw material prices, complex regulatory compliance requirements, and intense competition. Supply chain disruptions, though not currently quantified, can significantly impact production and delivery schedules.

Growth Drivers in the India Industrial Pump Market Market

The India industrial pump market is primarily driven by industrial expansion, infrastructural development, and the increased adoption of energy-efficient and technologically advanced pump solutions. Government regulations promoting energy efficiency and water management initiatives are also key drivers.

Challenges Impacting India Industrial Pump Market Growth

The market faces challenges from volatile raw material costs, stiff competition, and regulatory compliance complexities. Supply chain disruptions pose additional obstacles to consistent production and timely deliveries.

Key Players Shaping the India Industrial Pump Market Market

- La Gajjar Machineries Pvt Ltd

- Shakti Pumps (India) Ltd

- Falcon Pumps Pvt Ltd

- Xylem Inc

- Chemlin Pumps and Valves Pvt Ltd

- KSB SE & Co KGA

- Unnati Pumps Pvt Ltd

- Crompton Greaves Consumer Electricals Limited

- CNP Pumps India Pvt Ltd

- Kishor Pumps Pvt Ltd

- Usha International Limited

- CRI Pumps Pvt Ltd

- V-Guard Industries Limited

- Grundfos AS

- Kirloskar Brother Limited

Significant India Industrial Pump Market Industry Milestones

- April 2023: Kirloskar Brothers Limited launches the DBxe Pump, showcasing Indian innovation in meeting global pumping demands.

- November 2022: Roto Pumps Limited secures a large order for screw pumps from Suez India Pvt. Ltd., indicating strong market demand.

Future Outlook for India Industrial Pump Market Market

The future of the India industrial pump market looks bright. Continued industrial expansion, government initiatives in infrastructure development, and technological advancements promise sustained growth. Strategic investments in energy efficiency and smart technologies will be crucial for companies seeking market leadership. The market holds significant potential for growth and innovation in the coming years.

India Industrial Pump Market Segmentation

-

1. Type

- 1.1. Centrifugal Pump

- 1.2. Positive Displacement Pump

-

2. End-User Industry

- 2.1. Oil and Gas

- 2.2. Water and Wastewater

- 2.3. Chemicals and Petrochemicals

- 2.4. Mining

- 2.5. Power Generation

- 2.6. Other End-user Industries

India Industrial Pump Market Segmentation By Geography

- 1. India

India Industrial Pump Market Regional Market Share

Geographic Coverage of India Industrial Pump Market

India Industrial Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Industrialization4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment

- 3.4. Market Trends

- 3.4.1. Centrifugal Pump Expected to Dominate the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Industrial Pump Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Centrifugal Pump

- 5.1.2. Positive Displacement Pump

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Oil and Gas

- 5.2.2. Water and Wastewater

- 5.2.3. Chemicals and Petrochemicals

- 5.2.4. Mining

- 5.2.5. Power Generation

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 La Gajjar Machineries Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shakti Pumps (India) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Falcon Pumps Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xylem Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chemlin Pumps and Valves Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KSB SE & Co KGA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Unnati Pumps Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Crompton Greaves Consumer Electricals Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CNP Pumps India Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kishor Pumps Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Usha International Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CRI Pumps Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 V-Guard Industries Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Grundfos AS

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kirloskar Brother Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 La Gajjar Machineries Pvt Ltd

List of Figures

- Figure 1: India Industrial Pump Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Industrial Pump Market Share (%) by Company 2025

List of Tables

- Table 1: India Industrial Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Industrial Pump Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: India Industrial Pump Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: India Industrial Pump Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 5: India Industrial Pump Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Industrial Pump Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: India Industrial Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: India Industrial Pump Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: India Industrial Pump Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: India Industrial Pump Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 11: India Industrial Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Industrial Pump Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Industrial Pump Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the India Industrial Pump Market?

Key companies in the market include La Gajjar Machineries Pvt Ltd, Shakti Pumps (India) Ltd, Falcon Pumps Pvt Ltd, Xylem Inc, Chemlin Pumps and Valves Pvt Ltd, KSB SE & Co KGA, Unnati Pumps Pvt Ltd, Crompton Greaves Consumer Electricals Limited, CNP Pumps India Pvt Ltd, Kishor Pumps Pvt Ltd, Usha International Limited, CRI Pumps Pvt Ltd, V-Guard Industries Limited, Grundfos AS, Kirloskar Brother Limited.

3. What are the main segments of the India Industrial Pump Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.93 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Industrialization4.; Government Initiatives.

6. What are the notable trends driving market growth?

Centrifugal Pump Expected to Dominate the Market Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Investment.

8. Can you provide examples of recent developments in the market?

April 2023: Kirloskar Brothers Limited, a prominent pump manufacturing company in India, has recently unveiled its latest offering, the DBxe Pump. Boasting unique design parameters and a wide range of features, the introduction of the DBxe Pump marks a significant milestone for Kirloskar Brothers Limited. This launch showcases the company's commitment to meeting global pumping requirements by leveraging the finest aspects of Indian innovation and expertise.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Industrial Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Industrial Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Industrial Pump Market?

To stay informed about further developments, trends, and reports in the India Industrial Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence