Key Insights

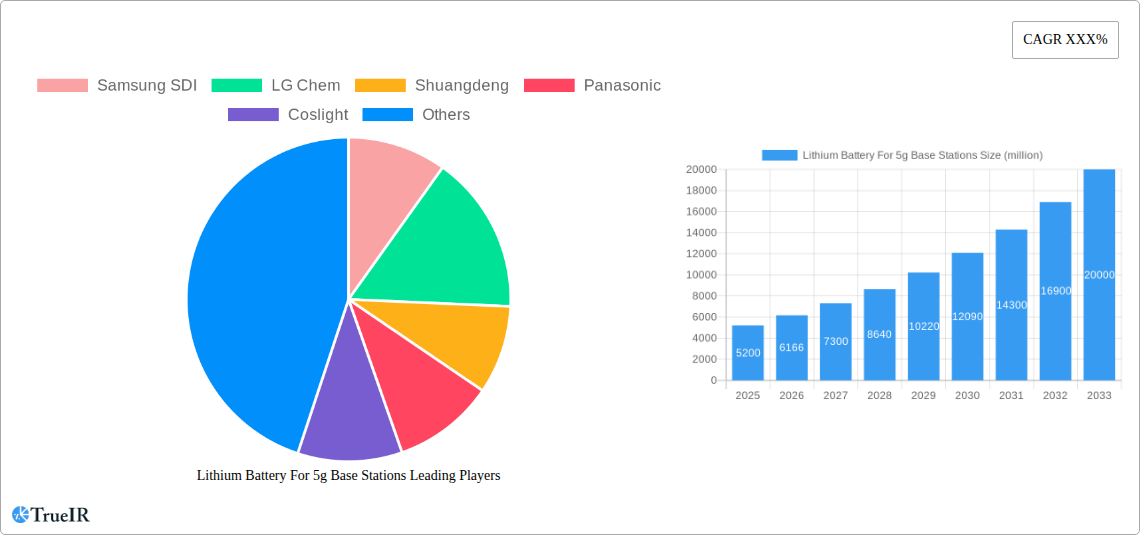

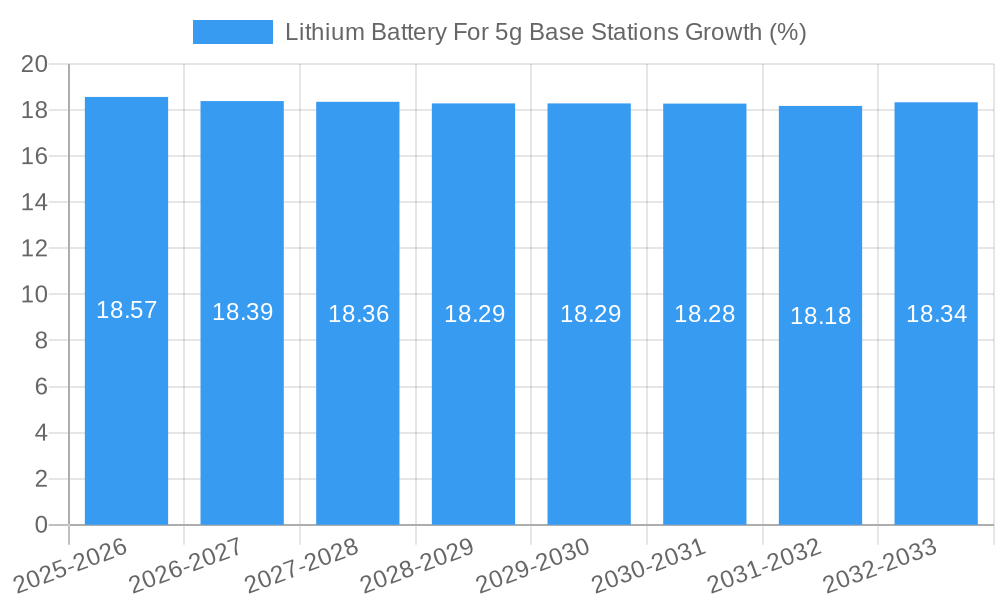

The global market for Lithium Batteries for 5G Base Stations is poised for substantial growth, driven by the rapid expansion of 5G infrastructure worldwide. With an estimated market size of approximately $5,200 million in 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) of around 18.5% through 2033. This surge is primarily fueled by the increasing demand for high-capacity, reliable, and long-lasting power solutions to support the enhanced performance and coverage of 5G networks. Key applications within this segment include primary power for base stations, backup power solutions ensuring network continuity during outages, and energy storage systems that optimize power utilization. The need for uninterrupted connectivity and the critical role of base stations in enabling advanced applications like IoT, autonomous vehicles, and enhanced mobile broadband are fundamental drivers.

The market's trajectory is further shaped by several key trends, including advancements in battery technology leading to higher energy density, improved safety features, and extended cycle life, all crucial for the demanding environment of base stations. Innovations in lithium-ion chemistries, such as LFP (Lithium Iron Phosphate) and NMC (Nickel Manganese Cobalt), are offering compelling alternatives with different cost and performance profiles. Furthermore, the growing focus on renewable energy integration with 5G infrastructure, utilizing batteries for solar and wind power storage, presents another significant growth avenue. However, challenges such as the initial high cost of advanced battery systems, supply chain complexities for critical raw materials, and the need for specialized thermal management systems in outdoor base station deployments could pose restraints. Nevertheless, the compelling advantages of lithium batteries in terms of performance, efficiency, and environmental benefits are expected to outweigh these challenges, solidifying their indispensable role in powering the 5G revolution. Leading companies like Samsung SDI, LG Chem, and Panasonic are at the forefront of innovation, investing heavily in R&D to meet the evolving demands of this critical market segment.

Lithium Battery For 5G Base Stations: Market Analysis and Forecast 2025-2033

Report Description:

This comprehensive market research report delves into the dynamic and rapidly evolving Lithium Battery for 5G Base Stations Market. Driven by the global rollout of 5G infrastructure, this report provides in-depth analysis, strategic insights, and actionable intelligence for stakeholders. We cover the market structure, competitive landscape, key trends, emerging opportunities, dominant segments, product innovations, growth drivers, and challenges impacting the industry. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report offers a robust understanding of market dynamics and future potential.

Leveraging high-volume SEO keywords such as "5G battery solutions," "telecom battery market," "Li-ion for base stations," "next-generation power solutions," and "wireless infrastructure batteries," this report is optimized for maximum search visibility and engagement with industry professionals, investors, and technology providers. We meticulously analyze the contributions of leading companies, including Samsung SDI, LG Chem, Shuangdeng, Panasonic, Coslight, Sacred Sun, ZTT, EVE Energy, EEMB, Vision Group, Topband, Zhejiang GBS, UFO battery, and others. The report examines critical segments like Application and Type, providing detailed breakdowns and forecasting market penetration.

Key findings will equip businesses with the knowledge to navigate market complexities, capitalize on growth prospects, and mitigate potential risks. This report is an essential resource for anyone involved in the 5G ecosystem, power solutions, battery technology, or telecommunications infrastructure.

Lithium Battery For 5G Base Stations Market Structure & Competitive Landscape

The Lithium Battery for 5G Base Stations Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Innovation remains a primary driver, fueled by the relentless pursuit of higher energy density, improved cycle life, and enhanced safety features to meet the demanding power requirements of 5G networks. Regulatory impacts, while evolving, are generally supportive, with governments worldwide prioritizing 5G deployment and encouraging the adoption of advanced energy storage solutions. Product substitutes, such as traditional lead-acid batteries, are increasingly being phased out due to their inferior performance and environmental concerns, further solidifying the dominance of lithium-ion technologies.

End-user segmentation reveals a clear focus on telecommunication operators and infrastructure providers who are the primary consumers of these batteries. Mergers and acquisitions (M&A) trends are notable, as larger companies seek to consolidate their market position, expand their product portfolios, and secure crucial supply chains. The M&A volume is estimated to be in the range of hundreds of millions to billions of dollars, reflecting the strategic importance of this sector. The market concentration ratio (CR4) is estimated to be around 65-70%, indicating a strong presence of the top four players. The continuous advancement in battery chemistries, such as LFP (Lithium Iron Phosphate) and NMC (Nickel Manganese Cobalt), along with ongoing research into solid-state batteries, are key innovation drivers. Furthermore, the increasing demand for sustainable and eco-friendly power solutions is influencing product development and regulatory frameworks.

Lithium Battery For 5G Base Stations Market Trends & Opportunities

The Lithium Battery for 5G Base Stations Market is poised for substantial growth, driven by the accelerating global deployment of 5G infrastructure. The market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of over 18% during the forecast period. This robust growth trajectory is underpinned by a confluence of technological shifts, evolving consumer preferences towards enhanced connectivity, and intensifying competitive dynamics. As more countries and regions commit to 5G rollout, the demand for reliable, high-performance, and long-lasting battery solutions for base stations will surge.

Technological advancements are at the forefront of market evolution. Innovations in lithium-ion battery chemistries are leading to higher energy densities, enabling smaller and lighter battery packs that are crucial for space-constrained base station sites. Improved cycle life and faster charging capabilities are also key developments, reducing operational costs and enhancing the reliability of 5G networks. Furthermore, the increasing emphasis on renewable energy integration in base station power systems is driving the demand for advanced battery management systems (BMS) and hybrid energy storage solutions.

Consumer preferences are indirectly influencing the market through the demand for seamless and high-speed connectivity. The proliferation of 5G-enabled devices and applications, from enhanced mobile broadband to the Internet of Things (IoT) and autonomous systems, necessitates a robust and dependable 5G network. This, in turn, translates into a greater need for high-capacity and efficient battery solutions for the underlying infrastructure.

Competitive dynamics are characterized by intense innovation and strategic partnerships. Leading battery manufacturers are investing heavily in research and development to stay ahead of the curve, while telecommunication companies are seeking long-term supply agreements to ensure the stability and scalability of their 5G deployments. The market penetration of advanced lithium batteries in 5G base stations, currently estimated to be around 70-75%, is expected to reach over 95% by the end of the forecast period. The growing demand for energy-efficient and environmentally friendly power solutions is also a significant trend, pushing manufacturers to develop batteries with lower carbon footprints and improved recyclability. The shift from traditional backup power solutions to more advanced lithium-ion technologies is a dominant trend, driven by superior performance, longer lifespan, and reduced total cost of ownership for telecom operators. The increasing need for reliable power in remote and off-grid base station locations further amplifies the demand for advanced battery systems.

Dominant Markets & Segments in Lithium Battery For 5G Base Stations

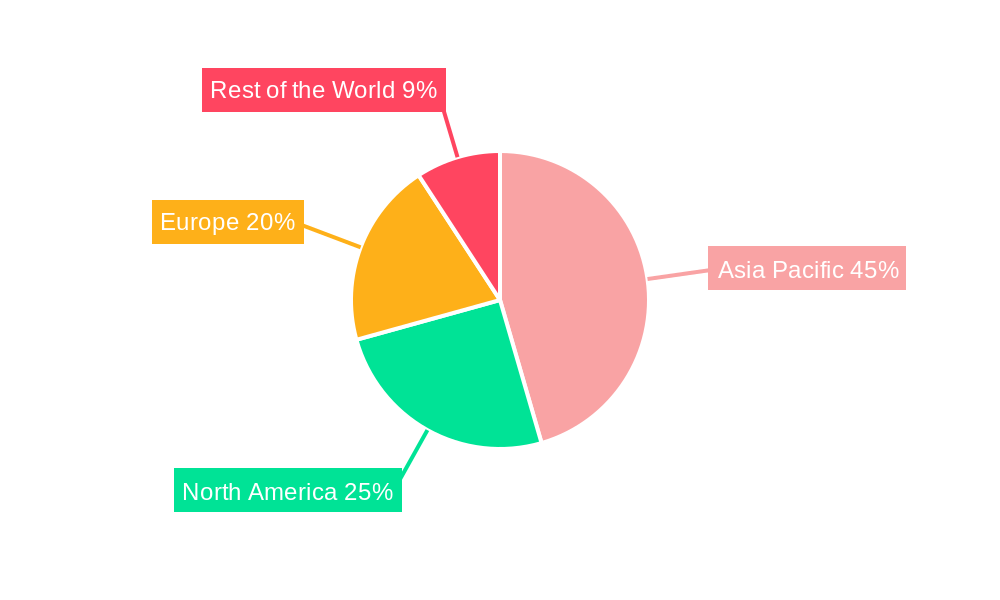

The Lithium Battery for 5G Base Stations Market is experiencing significant growth across various regions and segments, driven by infrastructure development and supportive government policies. Among the dominant markets, Asia Pacific, particularly China, is a leading region due to its aggressive 5G network build-out and substantial manufacturing capabilities. North America and Europe are also significant markets, fueled by ongoing 5G deployments and technological advancements. The Application segment is primarily dominated by Base Station Power Backup, where lithium batteries provide critical uninterruptible power supply, ensuring network reliability even during grid outages. The Type segment sees a strong dominance of Lithium Iron Phosphate (LFP) batteries, owing to their enhanced safety, longer cycle life, and cost-effectiveness compared to other lithium-ion chemistries, making them ideal for the demanding operational environments of 5G base stations.

Key growth drivers for market dominance include:

- Massive 5G Infrastructure Rollout: Governments worldwide are investing billions of dollars in expanding 5G networks, creating an insatiable demand for reliable power solutions.

- Government Policies and Incentives: Favorable policies, subsidies, and regulatory frameworks promoting 5G adoption and renewable energy integration are accelerating market growth.

- Technological Advancements: Continuous improvements in lithium battery technology, such as increased energy density and faster charging, are making them more suitable for 5G applications.

- Demand for Network Reliability: The critical nature of 5G services necessitates robust backup power solutions, where lithium batteries excel.

- Cost-Effectiveness and Long Lifespan: Despite higher initial costs, the extended lifespan and lower maintenance requirements of lithium batteries offer a competitive total cost of ownership.

In the Application segment, beyond power backup, there's growing interest in hybrid energy storage systems that integrate batteries with renewable energy sources like solar and wind for more sustainable base station operations. This segment is expected to witness substantial growth as operators aim to reduce their carbon footprint and operational costs.

Within the Type segment, while LFP currently dominates, there is ongoing research and development into Nickel Manganese Cobalt (NMC) and Solid-State Batteries. NMC offers higher energy density, which could be beneficial for space-constrained deployments, while solid-state batteries promise even greater safety and performance improvements in the future. The market share of LFP in 2025 is estimated to be around 70-75%, with a projected decline to 60-65% by 2033 as other chemistries gain traction.

Lithium Battery For 5G Base Stations Product Analysis

The Lithium Battery for 5G Base Stations Market is characterized by a continuous stream of product innovations focused on enhancing performance, reliability, and safety. Key advancements include the development of higher energy density lithium-ion cells, leading to more compact and lightweight battery solutions essential for the constrained spaces of 5G base station sites. Extended cycle life and improved thermal management systems are crucial for ensuring uninterrupted operation in diverse environmental conditions. Competitive advantages are derived from superior charge/discharge rates, enhanced safety features such as improved overcharge protection, and the integration of intelligent battery management systems (BMS) for optimized performance and longevity. The widespread adoption of Lithium Iron Phosphate (LFP) chemistry offers a compelling combination of safety, affordability, and a long operational lifespan, making it a preferred choice for base station applications. Furthermore, manufacturers are focusing on modular battery designs for ease of deployment and scalability, catering to the evolving needs of 5G network expansion.

Key Drivers, Barriers & Challenges in Lithium Battery For 5G Base Stations

Key Drivers:

The Lithium Battery for 5G Base Stations Market is propelled by several potent forces. The most significant driver is the unprecedented global rollout of 5G networks, necessitating a robust and reliable power infrastructure. Governments worldwide are actively supporting this expansion through policies and investments, further accelerating demand. Technological advancements in lithium-ion battery chemistry, including higher energy density and improved cycle life, make them increasingly suitable for the demanding requirements of base stations. The growing emphasis on energy efficiency and sustainability in telecommunications operations also favors lithium batteries over traditional alternatives. The need for enhanced network uptime and resilience against power outages is a critical factor, driving the adoption of advanced battery backup solutions.

Barriers & Challenges:

Despite the strong growth trajectory, the market faces several challenges. High initial capital costs for lithium battery systems can be a deterrent for some operators, although this is offset by lower total cost of ownership over time. Supply chain volatility and raw material price fluctuations, particularly for lithium, cobalt, and nickel, pose a significant risk to manufacturing costs and availability. Regulatory complexities and evolving standards related to battery safety, recycling, and disposal can create hurdles for market entry and expansion. Intensifying competitive pressures among established players and emerging manufacturers demand continuous innovation and cost optimization. Infrastructure limitations in some remote areas for charging and maintenance can also present challenges. The recycling infrastructure for lithium batteries is still developing, which can raise environmental concerns.

Growth Drivers in the Lithium Battery For 5G Base Stations Market

The Lithium Battery for 5G Base Stations Market is experiencing robust growth fueled by several interconnected factors. The global expansion of 5G infrastructure is the primary catalyst, creating an immense demand for reliable power solutions. Governments worldwide are enacting supportive policies and providing substantial investments to expedite 5G deployment, directly benefiting the battery market. Technological innovation, specifically advancements in energy density, cycle life, and safety features of lithium-ion batteries, makes them increasingly viable and efficient for base station applications. Furthermore, the telecommunications industry's focus on energy efficiency and reducing operational costs aligns perfectly with the long-term benefits of lithium battery technology, such as lower maintenance and extended lifespan. The increasing need for uninterrupted network service and resilience against power disruptions is also a significant driver, solidifying the role of lithium batteries as essential backup power sources.

Challenges Impacting Lithium Battery For 5G Base Stations Growth

Several critical challenges can impact the growth of the Lithium Battery for 5G Base Stations Market. The high upfront investment cost associated with advanced lithium battery systems remains a significant barrier for some telecommunications operators, despite the long-term cost advantages. Supply chain disruptions and price volatility of key raw materials like lithium, cobalt, and nickel can lead to unpredictable manufacturing costs and potential shortages. Navigating complex and evolving regulatory landscapes concerning battery safety, disposal, and environmental impact requires continuous adaptation and compliance. Intense competition among battery manufacturers necessitates constant innovation and cost-effectiveness to maintain market share. Additionally, the scalability and maturity of the battery recycling infrastructure for lithium-ion technologies present environmental and logistical challenges. The geopolitical landscape can also influence the sourcing of raw materials and the overall stability of the supply chain.

Key Players Shaping the Lithium Battery For 5G Base Stations Market

- Samsung SDI

- LG Chem

- Shuangdeng

- Panasonic

- Coslight

- Sacred Sun

- ZTT

- EVE Energy

- EEMB

- Vision Group

- Topband

- Zhejiang GBS

- UFO battery

Significant Lithium Battery For 5G Base Stations Industry Milestones

- 2019: Increased global announcements and initial deployments of 5G networks begin, driving early demand for specialized battery solutions.

- 2020: Key manufacturers start to offer tailored lithium battery solutions specifically for 5G base station backup power applications.

- 2021: Significant investments in R&D for higher energy density and longer cycle life lithium-ion chemistries for telecom infrastructure.

- 2022: Growing adoption of Lithium Iron Phosphate (LFP) batteries for 5G base stations due to their enhanced safety and cost-effectiveness.

- 2023: Partnerships between battery manufacturers and telecommunication equipment providers intensify to optimize integrated power solutions for 5G.

- 2024: Emergence of smart battery management systems (BMS) with advanced analytics for remote monitoring and predictive maintenance of base station batteries.

- 2025: Forecast year for significant market expansion driven by the acceleration of global 5G network build-outs.

- 2026: Expected breakthroughs in solid-state battery technology begin to show promise for future 5G infrastructure applications.

- 2028: Increased focus on sustainable battery sourcing and end-of-life recycling solutions for lithium batteries used in 5G networks.

- 2030: Lithium batteries become the de facto standard for backup power in the vast majority of 5G base stations worldwide.

- 2033: Projected peak in market demand as 5G coverage reaches saturation and subsequent network upgrades become the focus.

Future Outlook for Lithium Battery For 5G Base Stations Market

The future outlook for the Lithium Battery for 5G Base Stations Market is exceptionally bright, characterized by sustained growth and continuous innovation. The ongoing global expansion of 5G networks will remain a primary growth catalyst, driving demand for reliable and high-performance battery solutions. Strategic opportunities lie in the development of even more energy-dense, cost-effective, and environmentally sustainable battery chemistries, including advancements in solid-state battery technology. The integration of AI-powered battery management systems for predictive maintenance and optimization will enhance operational efficiency. As the telecommunications industry increasingly prioritizes green energy initiatives, hybrid energy storage solutions that combine lithium batteries with renewable sources will gain significant traction. The market is poised for continued expansion, driven by the evolution of 5G into more advanced iterations and the proliferation of 5G-enabled applications.

Lithium Battery For 5g Base Stations Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Lithium Battery For 5g Base Stations Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Lithium Battery For 5g Base Stations REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lithium Battery For 5g Base Stations Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Lithium Battery For 5g Base Stations Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Lithium Battery For 5g Base Stations Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Lithium Battery For 5g Base Stations Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Lithium Battery For 5g Base Stations Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Lithium Battery For 5g Base Stations Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Samsung SDI

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LG Chem

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shuangdeng

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Panasonic

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coslight

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sacred Sun

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ZTT

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EVE Energy

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EEMB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vision Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Topband

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Zhejiang GBS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 UFO battery

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Samsung SDI

List of Figures

- Figure 1: Global Lithium Battery For 5g Base Stations Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Lithium Battery For 5g Base Stations Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Lithium Battery For 5g Base Stations Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Lithium Battery For 5g Base Stations Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Lithium Battery For 5g Base Stations Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Lithium Battery For 5g Base Stations Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Lithium Battery For 5g Base Stations Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Lithium Battery For 5g Base Stations Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Lithium Battery For 5g Base Stations Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Lithium Battery For 5g Base Stations Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Lithium Battery For 5g Base Stations Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Lithium Battery For 5g Base Stations Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Lithium Battery For 5g Base Stations Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Lithium Battery For 5g Base Stations Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Lithium Battery For 5g Base Stations Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Lithium Battery For 5g Base Stations Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Lithium Battery For 5g Base Stations Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Lithium Battery For 5g Base Stations Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lithium Battery For 5g Base Stations?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Lithium Battery For 5g Base Stations?

Key companies in the market include Samsung SDI, LG Chem, Shuangdeng, Panasonic, Coslight, Sacred Sun, ZTT, EVE Energy, EEMB, Vision Group, Topband, Zhejiang GBS, UFO battery.

3. What are the main segments of the Lithium Battery For 5g Base Stations?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lithium Battery For 5g Base Stations," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lithium Battery For 5g Base Stations report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lithium Battery For 5g Base Stations?

To stay informed about further developments, trends, and reports in the Lithium Battery For 5g Base Stations, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence