Key Insights

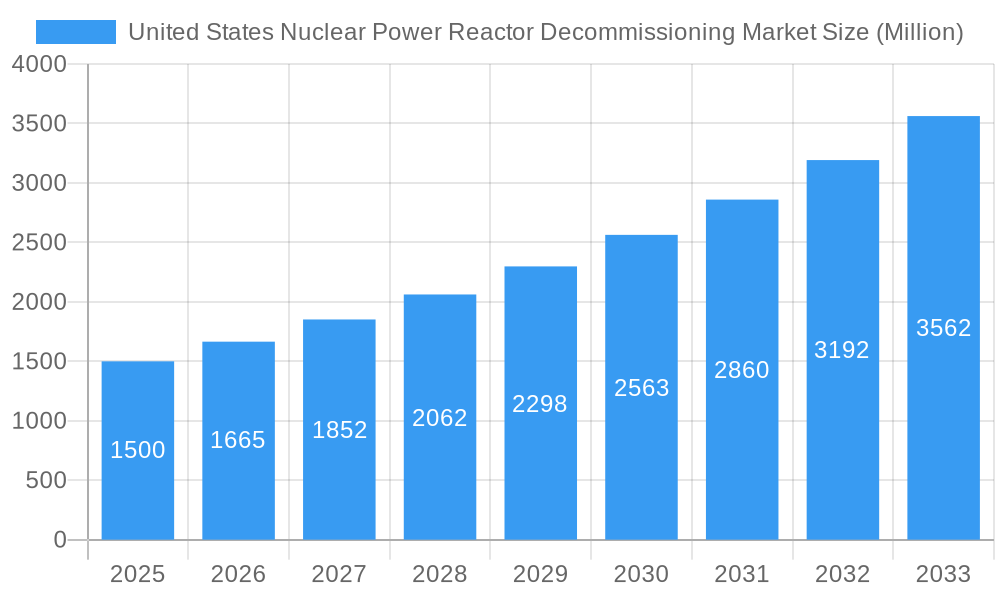

The United States Nuclear Power Reactor Decommissioning market is poised for substantial expansion, propelled by an aging nuclear fleet and escalating regulatory demands for safe and efficient dismantling. With a projected CAGR of 12.07%, the market size is estimated at $12.26 billion in the base year 2025. This valuation accounts for the significant capital and specialized expertise necessary for reactor dismantling, radioactive waste management, and site remediation.

United States Nuclear Power Reactor Decommissioning Market Market Size (In Billion)

The market is segmented by reactor type, including Pressurized Water Reactors (PWR) and Boiling Water Reactors (BWR), as well as by application (commercial, research) and plant capacity. PWRs, the most common reactor type in the US, are expected to lead market share. Decommissioning of larger capacity plants (over 1000 MW) significantly contributes to market value.

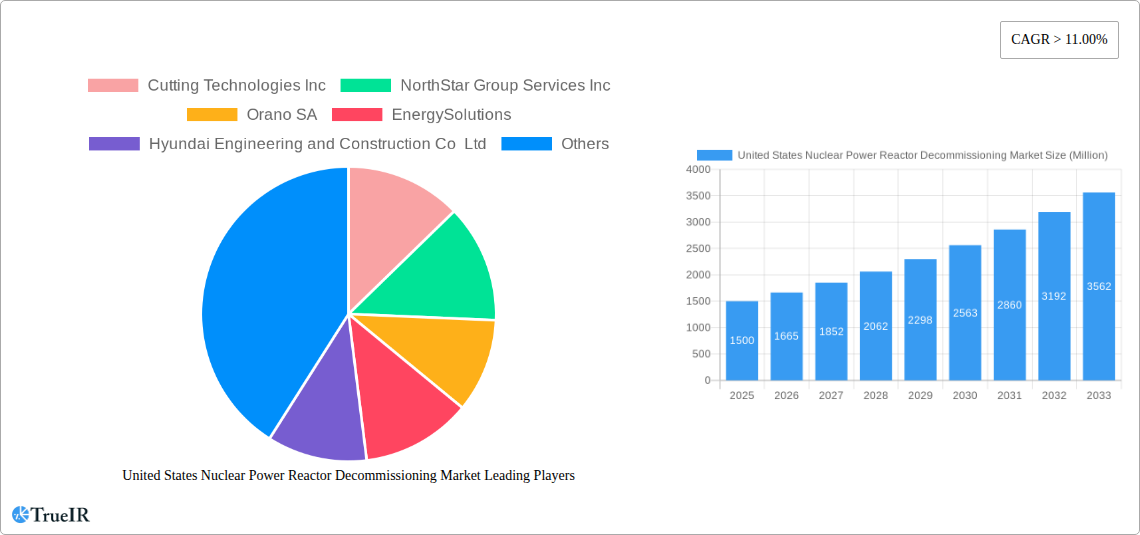

United States Nuclear Power Reactor Decommissioning Market Company Market Share

Key growth drivers include stringent regulatory compliance, heightened public environmental awareness, and effective spent nuclear fuel management. Conversely, challenges such as high decommissioning expenditures, complex radioactive material logistics, and potential regulatory delays may temper growth.

Leading market participants include Orano SA, EnergySolutions, Holtec International, and AECOM, alongside specialized firms like Cutting Technologies Inc. and NorthStar Group Services Inc. These companies offer comprehensive services from planning and dismantling to waste management and site remediation. The competitive landscape emphasizes specialized capabilities and advanced technologies, creating opportunities for both large corporations and niche providers.

The forecast period (2025-2033) anticipates sustained market growth driven by the impending decommissioning of numerous reactors. This consistent demand is expected to foster increased investment and innovation, leading to more streamlined and cost-effective decommissioning processes.

United States Nuclear Power Reactor Decommissioning Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States Nuclear Power Reactor Decommissioning market, offering invaluable insights for stakeholders across the nuclear power industry. Covering the period from 2019 to 2033, with a focus on 2025, this study explores market dynamics, key players, and future growth projections. The report is essential for investors, industry professionals, and government agencies seeking a clear understanding of this evolving sector.

United States Nuclear Power Reactor Decommissioning Market Structure & Competitive Landscape

The US nuclear power reactor decommissioning market is characterized by a moderately concentrated structure, with a handful of major players dominating the landscape. The market concentration ratio (CR4) for 2024 is estimated at xx%, indicating a moderate level of competition. Innovation is driven by the need for safer, faster, and more cost-effective decommissioning techniques, leading to ongoing research and development in areas like robotic dismantling and advanced waste management. Stringent regulatory oversight by the Nuclear Regulatory Commission (NRC) significantly impacts market operations, creating both opportunities and challenges for companies. The market experiences limited product substitution, with specialized expertise and equipment restricting entry. End-user segmentation includes commercial power reactor operators, research institutions, and government agencies. The past five years have witnessed a moderate volume of mergers and acquisitions (M&A) activity, driven primarily by industry consolidation and the pursuit of operational synergies. The number of M&A transactions in the period 2019-2024 is estimated at xx. This activity is expected to continue, albeit at a moderate pace, during the forecast period.

- Market Concentration: CR4 (2024) estimated at xx%.

- Innovation Drivers: Robotic dismantling, advanced waste management.

- Regulatory Impacts: Stringent NRC oversight.

- Product Substitutes: Limited substitutes due to specialized nature of the market.

- End-User Segmentation: Commercial power reactors, research institutions, government agencies.

- M&A Trends: Moderate level of activity (xx transactions between 2019-2024), driven by consolidation and synergies.

United States Nuclear Power Reactor Decommissioning Market Market Trends & Opportunities

The US nuclear power reactor decommissioning market is projected to experience significant growth over the forecast period (2025-2033). The market size is estimated at $xx Million in 2025 and is expected to reach $xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is driven by several factors including the aging US nuclear power plant fleet, which necessitates decommissioning activities, and increasingly stringent regulatory requirements. Technological advancements, such as the development of more efficient dismantling techniques and improved waste management solutions, are also fueling market growth. While the market faces challenges in terms of cost and regulatory complexities, opportunities exist for companies that can develop innovative and cost-effective solutions. Increasing environmental awareness and the need for responsible nuclear waste management create further growth opportunities. Market penetration rates for advanced decommissioning technologies are expected to increase significantly, reaching xx% by 2033. Competitive dynamics remain relatively stable, with established players continuously striving to improve efficiency and reduce costs.

Dominant Markets & Segments in United States Nuclear Power Reactor Decommissioning Market

The dominant segment within the US nuclear power reactor decommissioning market is the commercial power reactor application, which accounts for the largest share of the overall market. Within reactor types, Pressurized Water Reactors (PWRs) represent a significant portion, reflecting their prevalence in the US nuclear power fleet. The capacity segment of 100-1000 MW exhibits the highest growth due to the large number of plants falling within this range. The Northeast and Midwest regions of the US are leading markets due to the high concentration of aging nuclear plants in these areas.

- Key Growth Drivers:

- Aging nuclear power plant fleet.

- Stringent regulatory requirements for decommissioning.

- Technological advancements in dismantling and waste management.

- Increasing environmental awareness.

- Market Dominance: Commercial Power Reactor Applications, PWR Reactor Type, 100-1000 MW Capacity segment, Northeast and Midwest regions.

United States Nuclear Power Reactor Decommissioning Market Product Analysis

The market features a range of decommissioning products and services, from initial site assessments and fuel handling to waste management and site restoration. Significant innovations include robotic dismantling systems, advanced waste processing technologies, and improved safety protocols. Successful products demonstrate a superior combination of efficiency, safety, and cost-effectiveness, adapting to the unique requirements of various reactor types and decommissioning projects. Companies offering comprehensive service packages, integrating diverse technologies and expertise, typically hold a competitive advantage.

Key Drivers, Barriers & Challenges in United States Nuclear Power Reactor Decommissioning Market

Key Drivers: The aging US nuclear power plant fleet, stringent regulatory requirements, and technological advancements in decommissioning techniques are the primary forces propelling market growth. The rising cost of electricity and increasing focus on renewable energy sources are contributing indirectly to the need for efficient decommissioning of older reactors. Government support through funding and regulatory frameworks further incentivizes market expansion.

Challenges: Significant challenges include high upfront capital costs associated with decommissioning projects, complex regulatory approvals and licensing processes that prolong project timelines, and the potential for unexpected delays and cost overruns. Supply chain disruptions and the specialized nature of decommissioning equipment can also present significant obstacles. Competition amongst established players further adds to the pressure on profit margins. The lack of sufficient dedicated spent fuel storage facilities presents a key hurdle in the decommissioning process.

Growth Drivers in the United States Nuclear Power Reactor Decommissioning Market Market

The increasing age of existing nuclear power plants necessitates decommissioning efforts, driving market growth. Stringent regulatory requirements mandate safe and efficient decommissioning practices. Technological advancements, such as robotics and improved waste management solutions, reduce costs and improve efficiency.

Challenges Impacting United States Nuclear Power Reactor Decommissioning Market Growth

High capital costs, complex regulatory approvals, and potential for delays and cost overruns are significant hurdles. Supply chain limitations and the specialized nature of decommissioning equipment add to the challenges. Competition for contracts between established industry players keeps profit margins tight.

Key Players Shaping the United States Nuclear Power Reactor Decommissioning Market Market

- Cutting Technologies Inc

- NorthStar Group Services Inc

- Orano SA

- EnergySolutions

- Hyundai Engineering and Construction Co Ltd

- Holtec International

- AECOM

- Manafort Brothers Incorporated

Significant United States Nuclear Power Reactor Decommissioning Market Industry Milestones

- May 2022: Entergy Corporation initiated decommissioning of the 800 MW Palisades nuclear plant, setting a precedent for large-scale decommissioning projects and influencing future market activity.

- March 2022: Hyundai Engineering & Construction and Holtec's joint venture for the Indian Point Energy Center decommissioning demonstrates industry collaboration and highlights the scale of projects undertaken.

Future Outlook for United States Nuclear Power Reactor Decommissioning Market Market

The US nuclear power reactor decommissioning market is poised for continued growth driven by the aging reactor fleet and increasing regulatory pressures. Strategic opportunities exist for companies that can offer innovative, cost-effective, and safe decommissioning solutions, particularly in areas like advanced robotics, waste management, and site restoration. The market holds significant potential for expansion, with further growth projected over the coming decade.

United States Nuclear Power Reactor Decommissioning Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Boiling Water Reactor

- 1.4. High-temperature Gas-cooled Reactor

- 1.5. Liquid Metal Fast Breeder Reactor

- 1.6. Other Reactor Types

-

2. Application

- 2.1. Commercial Power Reactor

- 2.2. Prototype Power Reactor

- 2.3. Research Reactor

-

3. Capacity

- 3.1. Below 100 MW

- 3.2. 100-1000 MW

- 3.3. Above 1000 MW

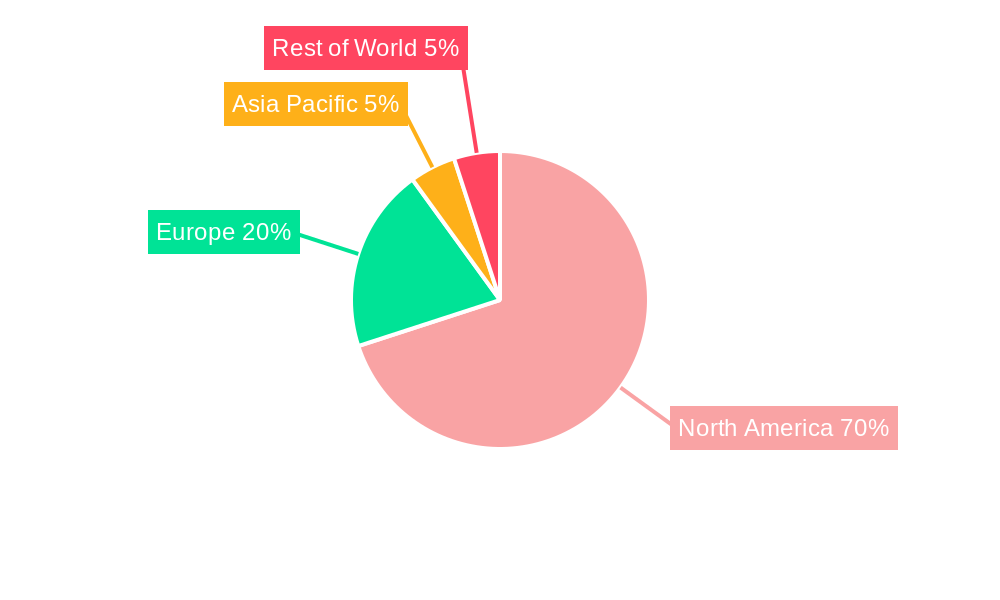

United States Nuclear Power Reactor Decommissioning Market Segmentation By Geography

- 1. United States

United States Nuclear Power Reactor Decommissioning Market Regional Market Share

Geographic Coverage of United States Nuclear Power Reactor Decommissioning Market

United States Nuclear Power Reactor Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Electricity Demand from Manufacturing

- 3.2.2 Construction

- 3.2.3 and Mining Industries4.; The Availability of a Broad Range of Fuel Sources for Electricity Generation

- 3.3. Market Restrains

- 3.3.1. 4.; Phasing Out of Coal-based Power Plants

- 3.4. Market Trends

- 3.4.1. Commercial Power Reactor Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Nuclear Power Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Boiling Water Reactor

- 5.1.4. High-temperature Gas-cooled Reactor

- 5.1.5. Liquid Metal Fast Breeder Reactor

- 5.1.6. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Power Reactor

- 5.2.2. Prototype Power Reactor

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. Below 100 MW

- 5.3.2. 100-1000 MW

- 5.3.3. Above 1000 MW

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cutting Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NorthStar Group Services Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orano SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EnergySolutions

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai Engineering and Construction Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Holtec

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Holtec International *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AECOM

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Manafort Brothers Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Cutting Technologies Inc

List of Figures

- Figure 1: United States Nuclear Power Reactor Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Nuclear Power Reactor Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 4: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 6: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 8: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Nuclear Power Reactor Decommissioning Market?

The projected CAGR is approximately 12.07%.

2. Which companies are prominent players in the United States Nuclear Power Reactor Decommissioning Market?

Key companies in the market include Cutting Technologies Inc, NorthStar Group Services Inc, Orano SA, EnergySolutions, Hyundai Engineering and Construction Co Ltd, Holtec, Holtec International *List Not Exhaustive, AECOM, Manafort Brothers Incorporated.

3. What are the main segments of the United States Nuclear Power Reactor Decommissioning Market?

The market segments include Reactor Type, Application, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.26 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand from Manufacturing. Construction. and Mining Industries4.; The Availability of a Broad Range of Fuel Sources for Electricity Generation.

6. What are the notable trends driving market growth?

Commercial Power Reactor Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Phasing Out of Coal-based Power Plants.

8. Can you provide examples of recent developments in the market?

May 2022: Entergy Corporation shut down its Palisades nuclear plant on Lake Michigan. The nuclear power plant had an 800 MW power generation capacity. The fuel was removed from the reactor's vessel and placed in the spent fuel pool to cool. After the cooling process, the fuel will be transported to the secured independent spent fuel storage facility on station property. Furthermore, the company aims to complete the decommissioning of the nuclear plant by 2041.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Nuclear Power Reactor Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Nuclear Power Reactor Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Nuclear Power Reactor Decommissioning Market?

To stay informed about further developments, trends, and reports in the United States Nuclear Power Reactor Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence